For businesses in need of working capital, invoice factoring can provide a quick and simple solution.

Invoice factoring is a financial tool that allows you to use your unpaid invoices as collateral for short-term loans. The process involves selling your accounts receivable (invoices) to a third-party lender who then pays you the full amount of the invoice minus their fee. This provides immediate access to cash which can be used to cover expenses or take advantage of new opportunities.

In this guide, we’ll explain how invoice factoring works, its advantages and disadvantages, and what factors you should consider when selecting an invoice factoring company. We’ll also discuss alternative financing options if invoice factoring isn’t right for your business needs. With this information in hand, you’ll be able to make an informed decision on whether or not using an invoice factor would benefit your business’s growth and success.

How Factoring Works

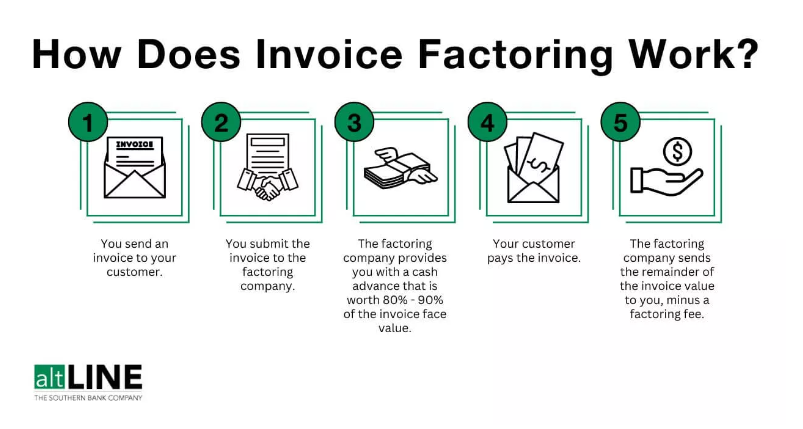

Invoice factoring or accounts receivable financing is an arrangement in which a third party, known as the factor, purchases your unpaid invoices at a discounted rate.

The factor pays you a percentage of the invoice’s value when you submit an invoice to them. They then collect payments on that invoice from your clients and pay you the remaining balance minus their fees for services rendered.

The Benefits of Factoring

Factoring can create immediate liquidity in your business and give you access to a reliable source of capital when needed. It also provides fast turnaround times and flexible terms so that you don’t have to wait for weeks or even months for payments from customers.

This means you can use the money to purchase essential equipment, hire employees, and cover other necessary expenses. You can also have access to more capital than a loan could provide as invoice factoring is based on your invoices’ value rather than your credit score or collateral.

Factoring gives businesses tremendous opportunities by creating more room to grow.

It can help you purchase new equipment and hire additional staff, which would naturally lead to increased productivity and better output. This in turn could lead to higher sales, bigger profits, and the much-needed financial stability for the business.

Is Factoring Business Profitable?

Invoice factoring is an efficient and cost-effective way of getting the working capital you need. The savings it offers by not having to wait for payments from clients can be reinvested in the business.

It also allows businesses to focus more on production than accounts receivable management, enabling them to take advantage of timely opportunities that might come along.

Overall, invoice factoring can be a great way to obtain the funds required for your business at competitive rates, giving you the opportunity to move forward and experience more growth. It’s an excellent way to create extra space in your workplace while taking advantage of lucrative opportunities.

What is a Good Rate for Factoring?

The rate you get when using invoice factoring is based on several factors including the creditworthiness of your customers and the length of time it takes for them to pay.

As an example, a rate of 1.5% per 30 days is considered an excellent rate since it provides you with instant access to working capital and enables you to reinvest the money in your business.

You should look for a factor that offers competitive rates and has flexible terms so that you can get profit margins that work best for your business.

Remember, invoice factoring can be a great way to make sure you have the financial resources needed for your business operations. It’s an ideal solution when you need more room in your workplace while taking advantage of new opportunities that arise along the way.

Make sure you get the best rate possible and reap all of its benefits!

How Risky is Factoring?

Invoice factoring is considered a low-risk form of financing since you are only leveraging your accounts receivable. In other words, you don’t have to put up any collateral or incur debt; the money you receive from the factor comes from payments made by your customers.

However, there are certain risks that come with invoice factoring, such as customer default on payment or missed payments. It’s important to be aware of these risks and take the necessary steps to mitigate them.

For example, you should make sure your customers have good credit ratings before engaging in factoring and always ensure that their accounts are up-to-date. You should also have a solid accounts receivable management process in place to ensure timely payments from your customers.

Why is Factoring so Expensive?

Factoring can sometimes be expensive because of the costs associated with it.

The factors will charge a fee for their services ranging from 1-3% of the invoice value each month, and in some cases, insurers may also require additional insurance fees. There are other costs to consider such as collection charges, auditing expenses and legal fees.

All of these costs can add up and make invoice factoring an expensive option, but the benefits far outweigh the cost. Factoring gives businesses tremendous opportunities by freeing them from waiting for funds to be released and allowing them to reinvest the money they earn in their business.

What is the #1 Rule of Factoring?

The number one rule of invoice factoring is to be sure that you are dealing with a reputable factor.

Make sure the factor has a good reputation and you can trust them to provide you with reliable services at competitive rates. You should also make sure that their terms are flexible enough for your needs, so you can be sure you’re getting the best deal.

Factoring Tips

Here are a few tips to keep in mind when factoring:

- Always read the fine print of any contract before signing it.

- Make sure your customers have good credit ratings and their accounts are up-to-date.

- Have a solid accounts receivable management process in place to ensure timely payments from your customers.

- Look for a factor that offers competitive rates and has flexible terms so that you can get profit margins that work best for your business.

- Research different factors to make sure you are getting the most favorable rate possible.

- Be aware of the risks associated with factorings, such as customer default on payment or missed payments, and take the necessary steps to mitigate them.

Factoring – The Catalyst Your Young Business Needs To Get Off The Ground

Invoice factoring is a reliable means of financing you can depend on to act as a catalyst for early growth. Here are some ways it can help you get off the ground.

Provides working capital when you need it

For a new business, the rule of spending money on making money applies well. Obviously, you cannot expect to survive unless you have consistent and sufficient working capital in place.

Borrowing money from friends or piling up personal debt to finance those early stages is not the best decision because it can actually result in a lot of pressure.

Invoice factoring offers working capital and facilitates the predictable cash flow that startups need. Moreover, they provide access to immediate funding which can make all the difference at the startup stage. And it is smart because you get an advance on your money rather than create a liability.

Offers the support you require

Starting a new venture is an uphill journey and entrepreneurs often have to struggle with wearing many hats at one time.

Collaboration with a good factoring company provides you the support you need, specifically when it comes to funding your business. For example, you can check this website to see how freight factoring works. This may be an advantage if you have just started a transportation company and don’t have much experience in terms of funding.

You get real, industry-specific insights that you can use for making smarter financing decisions for your business. While you can save time on procuring funds, there is also the advantage of value-added customer support you get from these providers.

Protects your business from bad debts

New businesses should steer clear of customers who aren’t reliable enough. Extending credit to such customers can put you in a fix. Therefore, you must screen the customers’ credit before dealing with them.

A factoring company can help you in this context because they will do extensive credit checks on your customers as a part of the factoring process. So you can be sure that they have the funds to pay you on the due date. While there is the assurance of payment, you also save time and effort that you would otherwise have to invest in screening and verifying prospective clients.

Considering these extensive benefits of factoring, it surely emerges as a smart choice for young businesses that need finance to fuel their growth. With all the stability it offers for the long haul and the working capital it provides for the short term, factoring is an option you can trust to take your business ahead.

Alternative Invoice Factoring Options

Besides traditional invoice factoring, there are a few alternative options that some entrepreneurs may be interested in exploring. Here are the two most popular:

Peer-to-peer Invoice Factoring

This is an online platform designed to connect businesses that need invoice factoring services with investors willing to fund them. This type of invoice factoring eliminates the need for a middleman and instead allows businesses to find investors themselves.

The process is often faster and more convenient than working with a traditional factoring company, but it also comes with its own risks.

Recourse Invoice Factoring

In this type of invoice factoring, the factor reserves the right to take back the money they have advanced to the business if the customer does not pay their invoice. This means that, even after the factoring company has paid out, you are still liable for any bad debts if your customer fails to pay.

Therefore, recourse invoice factoring is often viewed as an additional layer of protection against non-payment or late payment from a customer.

Final Words

Invoicing factoring is a great option for businesses that need access to immediate working capital.

It can provide the stability and support needed during the early stages of business, as well as protect them from bad debts. There are various types of invoice factoring available with different terms and conditions.

So, it is important to understand your own business needs before making a decision. With the right invoice factoring company, you can take advantage of this powerful financial tool to meet your business needs and ensure a bright future for your venture.