As a small business owner, or even as an employee, you probably already know that you should be preparing for retirement. It is unrealistic to think that you will be able to go on doing what you do for an infinite amount of time. While it may seem that retirement is a long way off, it’s just over the horizon, no matter how old you are. There are many ways to prepare to enjoy your golden years. If you are already preparing for that day, then great! However, are you doing the things you need to do in order to live comfortably and without regret?

Read on below for a few tips for preparing to take it easy when the time to retire comes.

Work to Buy Your Home

There are many different ways that you can secure a home to live in your entire life. From renting to securing a mortgage, the way you live is entirely up to you. However, living in a rental doesn’t help you in your retirement, whereas owning your home opens up avenues you wouldn’t have otherwise.

Work to Pay Off Your Mortgage

The first thing you should be doing is working to pay off the mortgage on your home. While you may have signed up for a 30-year mortgage, the quicker you pay the house off, the better off you will be in your older years. If your mortgage is paid off in your twilight years, it also opens the option for you to secure a reverse mortgage if the need arises. With this type of mortgage, it makes it possible for you to stay in your home and has many other benefits as well.

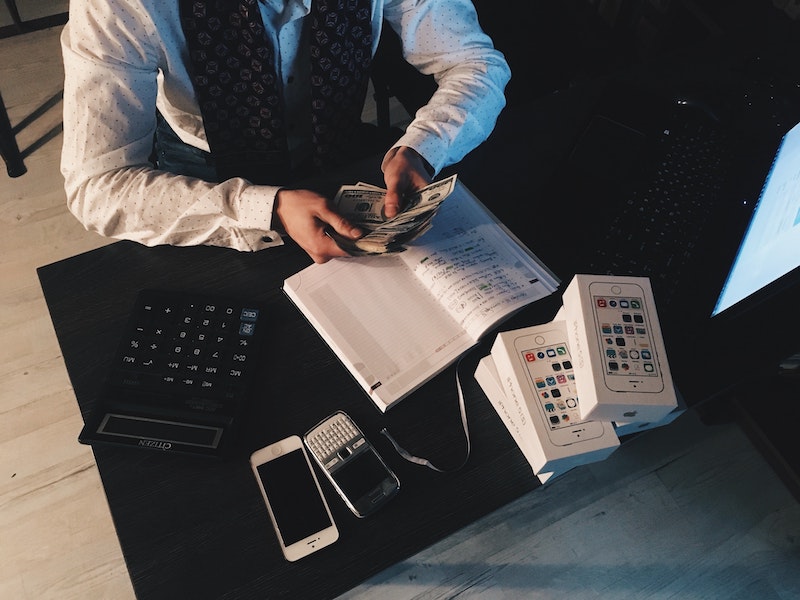

Set a Goal

The next thing you will want to do is set a goal. If you know how much you want to save towards your retirement, that is great. However, if you don’t have a realistic goal in mind, it will be easy to let it fall by the wayside in the long run. Set a realistic goal as to how much money you want to have saved by the time you reach retirement age. Write the goal down and hang it over your desk or even on the fridge so that you see it every time you work or get something to eat. It will be easier to work towards that dollar goal when it is written down than it will be if it’s just a number in your mind.

Related: Keeping Your Head Above The Financial Waters

Prepare for the Unexpected

You have a plan in motion, it’s going along great, then suddenly you are being forced to retire early. Whether it’s from an unexpected illness, layoffs at your job, or you simply want to get out of the rat race, preparing ahead of time for the unexpected is your best chance of still having a good retirement.

Work to Stay Fit and Healthy

While it might not seem to have anything to do with your financial security during retirement, working to stay fit and healthy should be one of your number one concerns. Taking care of yourself as you get older means that you can take up a hobby, hold down a part-time job, and be able just to enjoy life to the fullest in your retirement, instead of having to worry about health concerns and where the next meal is coming from.

These are just a few of the ways that you can start preparing for your golden years. Whether you are an employee or a business owner, you aren’t going to be able to keep going forever. Since there is no known fountain of youth, you need to prepare to get older, retire, and enjoy the rest of your life comfortably and in the style, you have become accustomed to over your long years of working. These tips will help you to do just that! Start preparing today for your tomorrow.